Outsource CFO Services

Unlock Your Business’s Full Financial Potential with Expert Guidance from Best CFO Solutions

Best CFO Solutions is a one-stop solution for all your Virtual CFO Needs

•Qualified Professionals

•Improved Customer Service

•Results- Driven

•Industry Knowledge

•Data Security

•Quick Turnaround Time

The significance of financial competence and profitability cannot be overemphasized, which is why businesses globally have collaborated with Best CFO Solutions for their outsourced CFO needs.

Whether you are a business looking for professional financial advice without wanting to hire a full-time CFO or a business looking to replace an existing CFO, Best CFO Solutions would be the perfect fit for you. Our team of professionals provides business owners, CEOs, boards of directors, and senior management with strategic insight, financial leadership, and perfect execution.

Whether you prefer to engage a consulting CFO, controller, or financial planning manager, our team applies best practices that have been developed and refined through extensive client engagements, to deliver tangible business results.

Reaching business objectives requires more than just meeting sales targets; it demands maximizing the business’s potential. So, our virtual CFO services and financial advisors make sure that each customer’s goals and expectations are met.

A virtual CFO may help organizations improve their financial strategy, overcome difficulties, and accelerate their growth. Companies can benefit from the experience of a virtual CFO without having to pay for a full-time CFO. With a virtual CFO, organizations may gain valuable insights and direction, helping them to make informed financial decisions and maintain a competitive advantage.

You can expect your firm to flourish and realize its full potential with Best CFO Solutions.

CFO Services We Offer

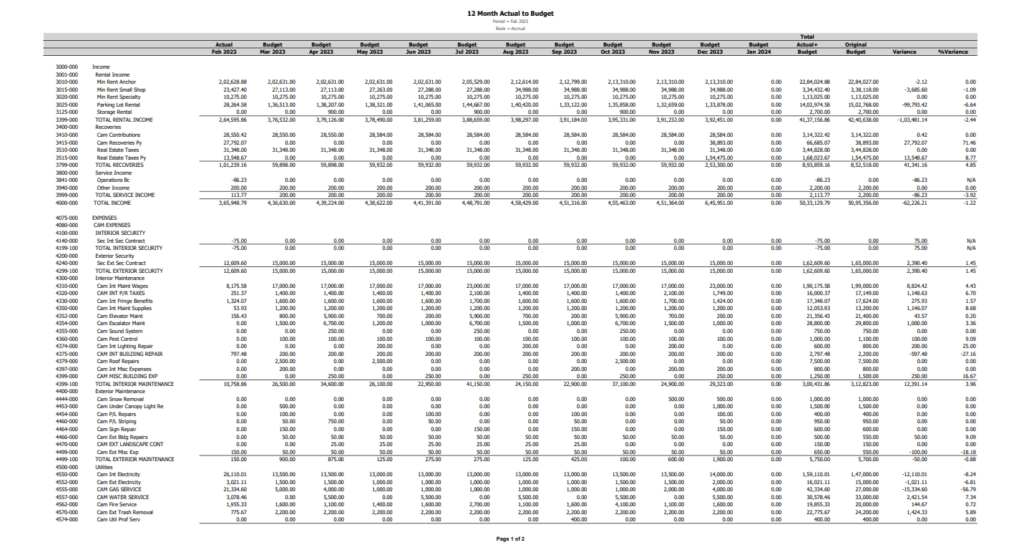

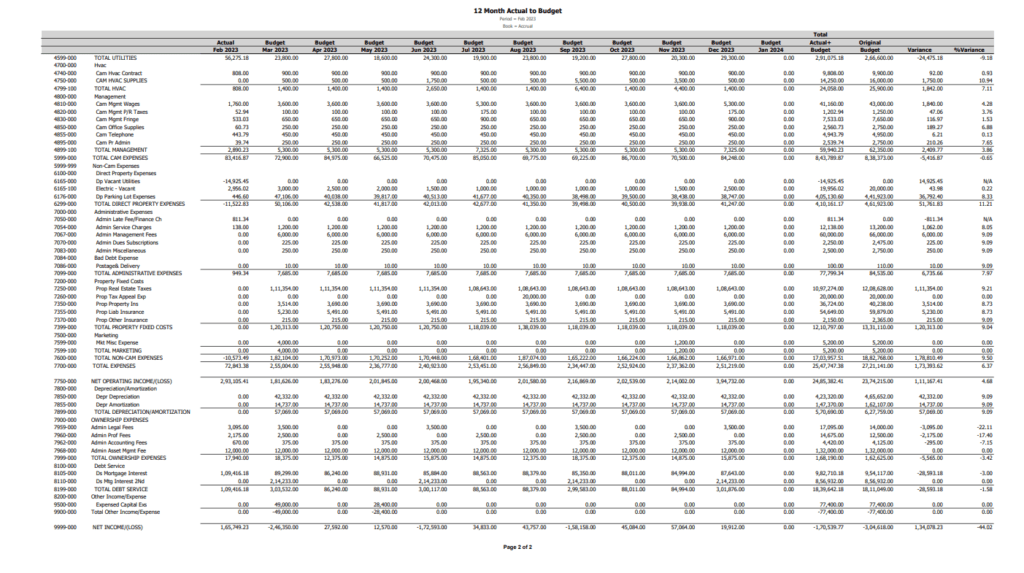

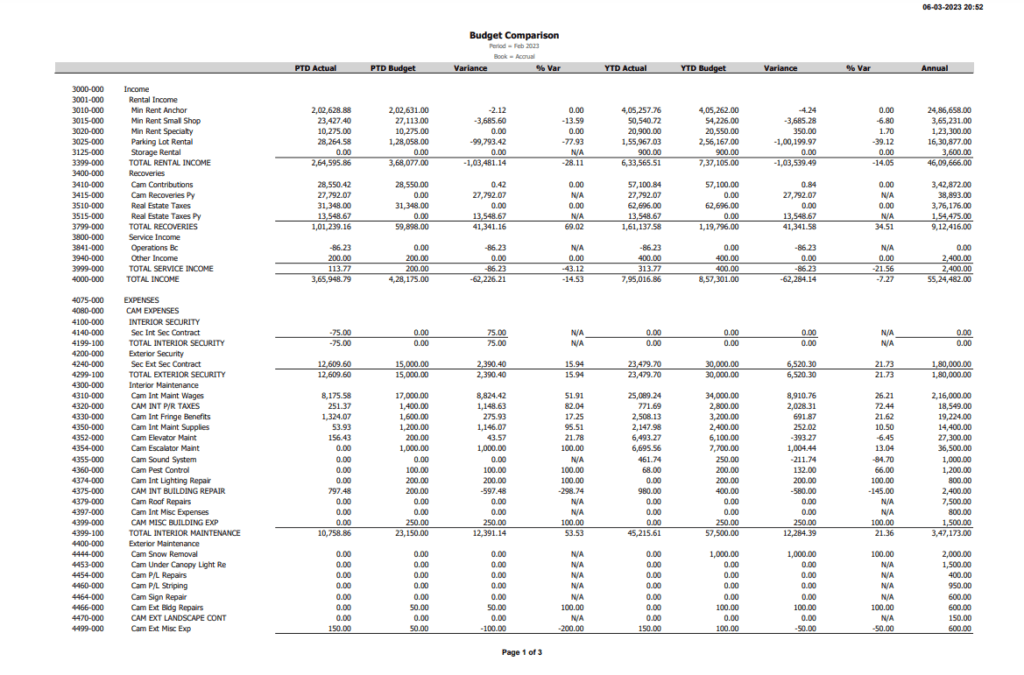

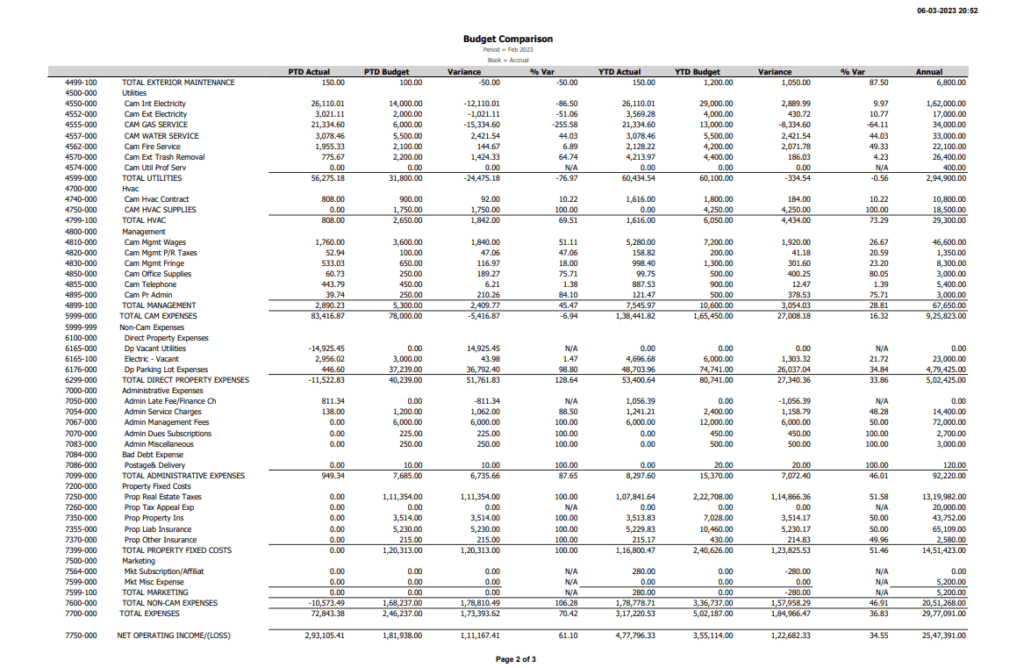

Budgeting

A budget is a detailed plan of projected finances for a shorter timeframe, while a forecast is a long-term projection of costs and operations. Both are important tools that help guide financial decisions and keep an organization on track to reach its goals. A strategic CFO may use a forecast as a rolling budget to ensure financial performance aligns with company goals.

Financial Strategy

A chief financial officers main advantage is providing advanced financial strategy to your business. Unlike other finance roles, a CFO is dedicated to developing a long-term plan for your organization. Outsourced CFOs specialize in creating strategies that take your business from its current position to where you want it to be in the future.

Financial Forecasting

A financial forecast is a crucial roadmap for any organization, providing a step-by-step guide to achieving your goals. It requires strategic analysis, an understanding of your company’s capabilities and financial trends, and an analysis of your industry’s competitive landscape. A CFO plays a critical role in shaping and executing the company’s financial strategy and forecasting.

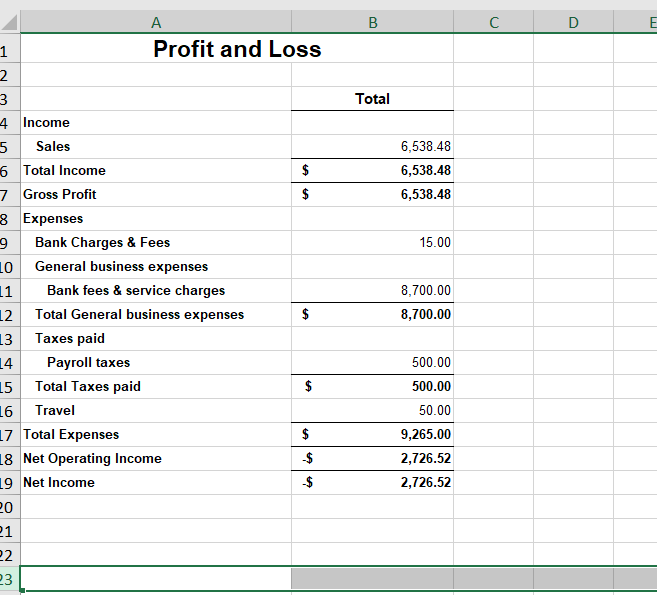

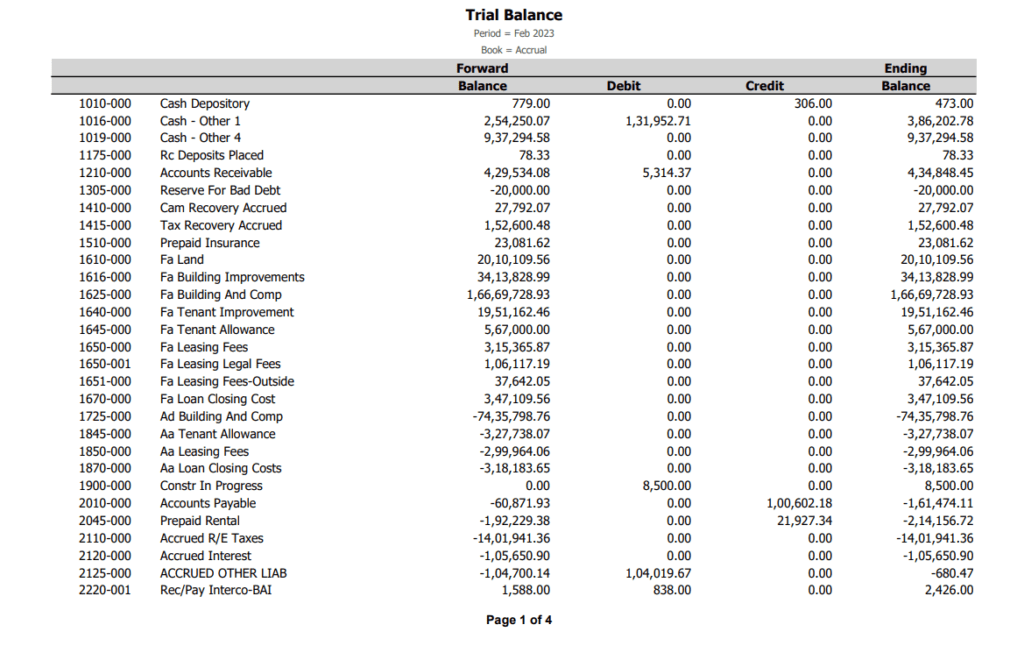

Financial Reporting

An outsourced CFO can facilitate financial report interpretation and analysis to keep you informed about your current and future financial status, providing you with important insights to support your business needs, make essential decisions, and stay updated on industry developments. Additionally, if you lack a reliable system for financial reporting, your CFO can assist in implementing a system for timely & accurate reporting.

Raising Capital

An outsourced CFO can assist in optimizing financials for investor/lender discussions, provide financial documents for due diligence, help determine financing needs and structure, add professionalism and represent the business during the process, and review/negotiate term sheets.

Capital Structuring

An outsourced chief financial officer assists in determining the optimal capital structure for your organization by evaluating the amount of financing required and the debt-to-equity ratio necessary to achieve growth while maintaining the company value.

Cash Flow Analysis & Restructuring

Outsourced CFOs analyze your financials to maximize your bottom line by renegotiating contracts, aligning pricing with trends, analyzing commission structures, managing the supply chain, and attributing costs to revenues.

Facilitating Mergers and Acquisitions

An outsourced CFO can provide valuable services during mergers, acquisitions, asset sales. This may include preliminary analysis & reporting, forecasting, stabilizing financial functions, advising key team members, & preparing documentation.

Profit Maximization

A CFO plays a crucial role in profit maximization by identifying opportunities for revenue growth, cost reduction, and operational efficiency while ensuring financial stability and compliance.

Risk Mitigation & Internal Controls

An outsourced CFO helps in identifying and mitigating risks to the organization’s financial health. They establish and monitor internal controls to prevent fraud, errors, and other financial missteps, ensuring compliance with laws and regulations.

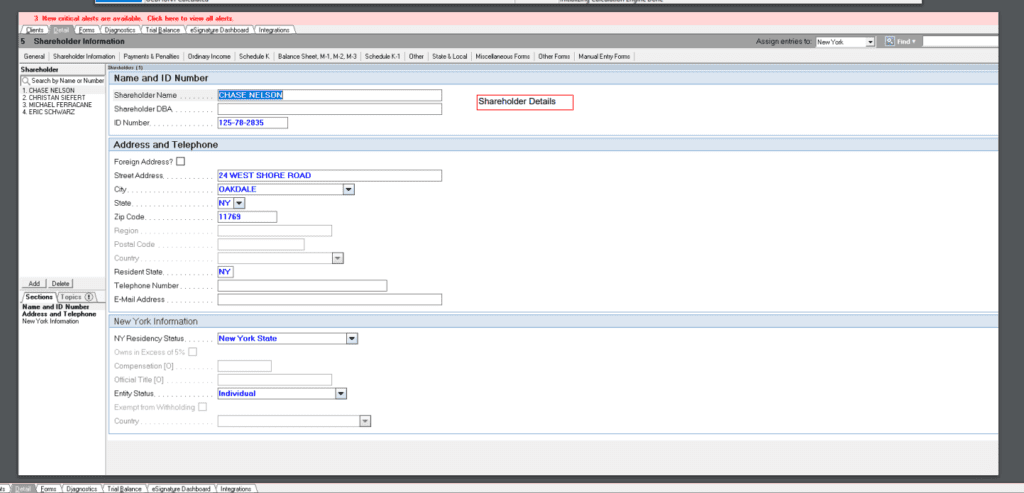

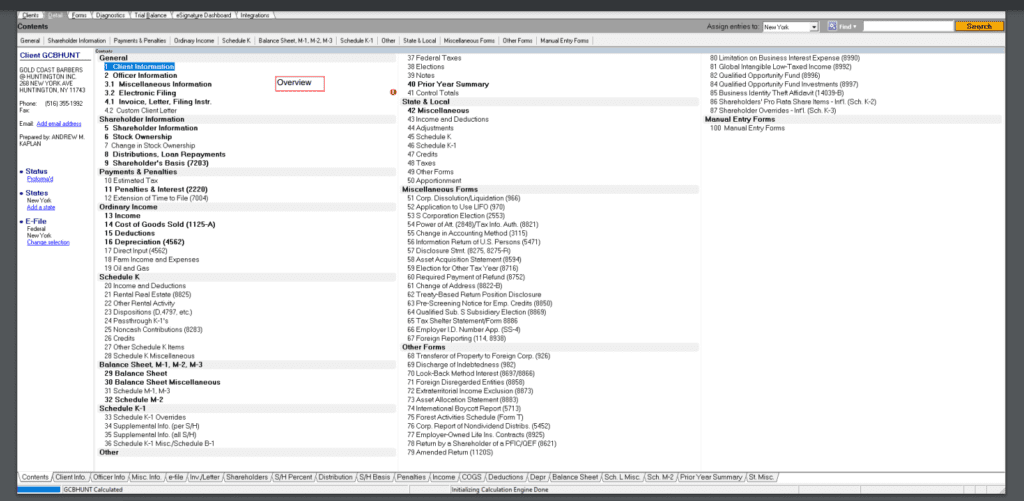

Accounting and Audit Support

The CFO is responsible for overseeing the financial reporting and accounting functions of the company, ensuring compliance with accounting principles and regulations. They collaborate with auditors to produce accurate financial statements and support the auditing process by identifying and resolving any issues that may arise.

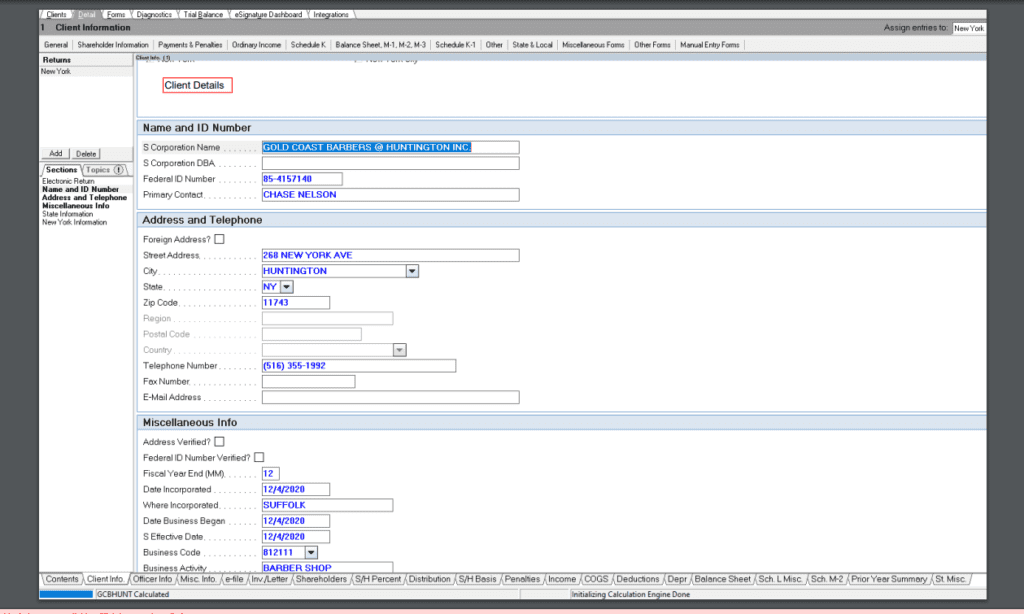

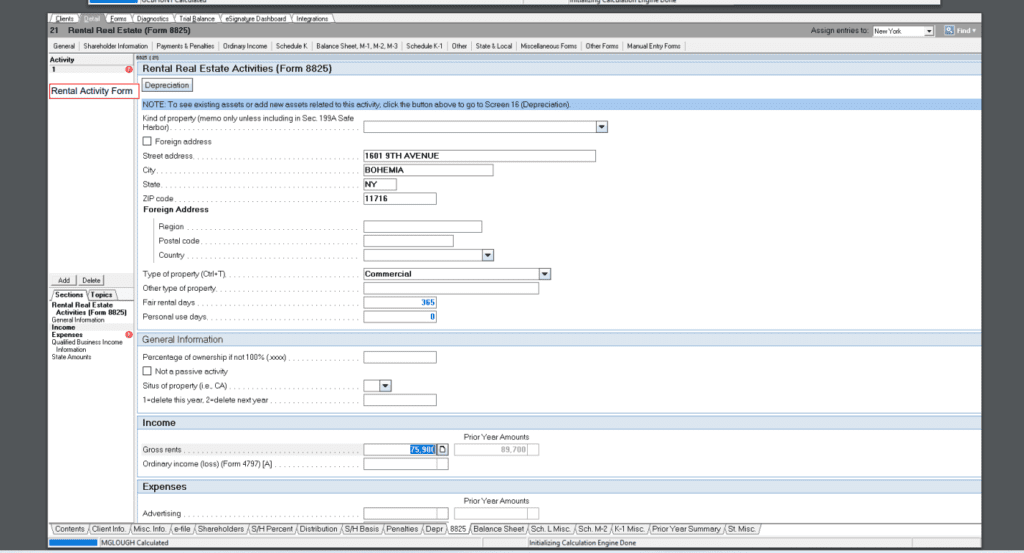

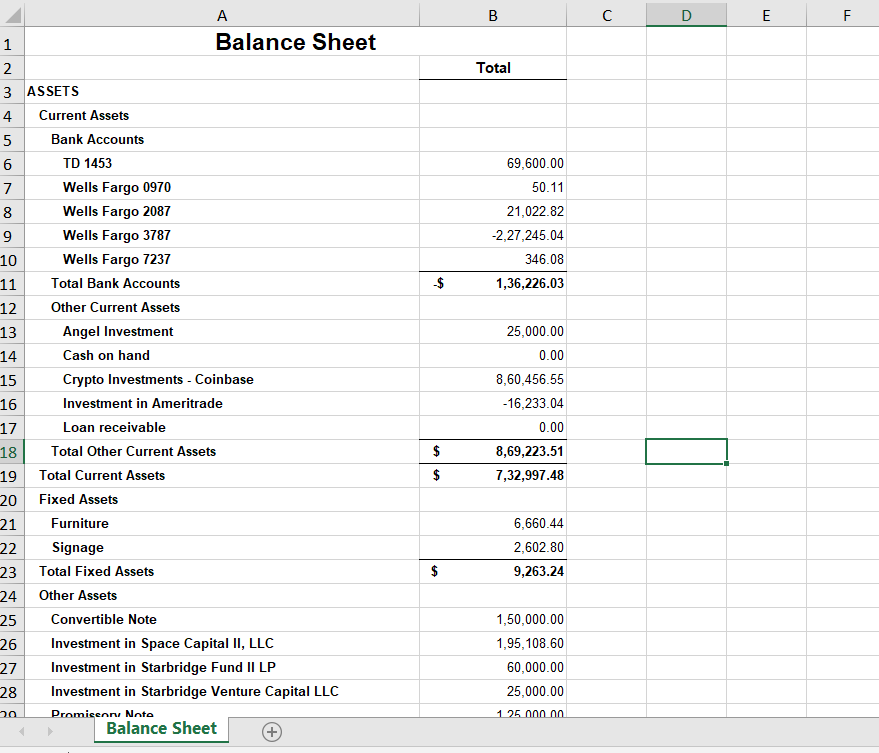

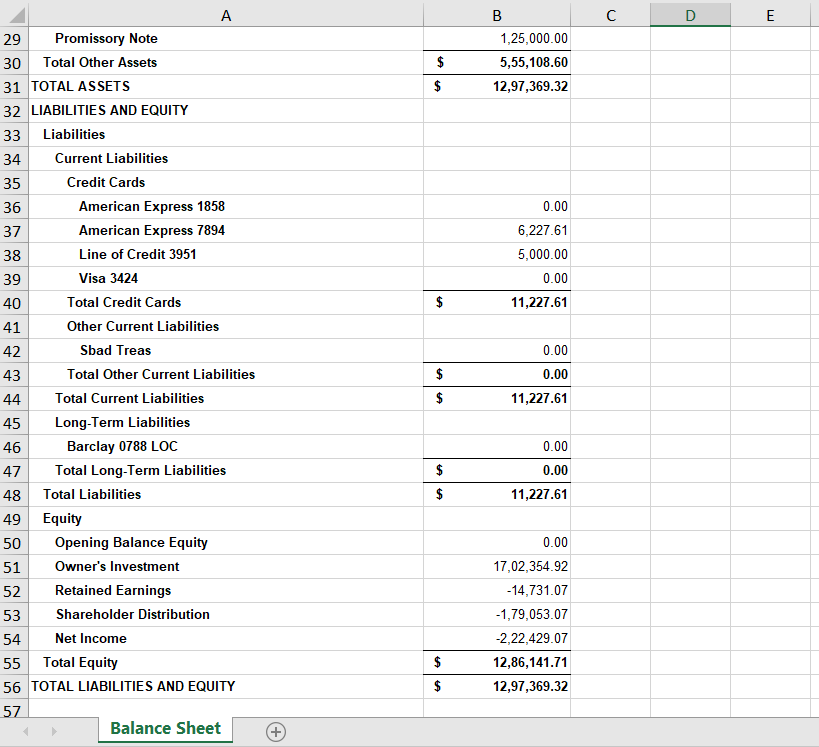

Our Accounting Portfolio

Our Client Testimonials

Lucia

Vice President

Fonzi

Project Manager

George

Founder

Rayn

CEO

Cateline

Co-Founder

We Utilize Top Industry Software

MS Dynamics 365 | SAP | FreshBooks | Sage | ADP | QuickBooks | Xero | Netsuite | Bill Com

Industries We Serve

Our team has extensive experience assisting companies across all industries and phases of development.

Nonetheless, we specialize in providing in-depth expertise to high-growth companies in the following fields:

- Manufacturing

- E-Commerce

- Software Development

- SAAS

- Venture Capital

- Fintech

- Healthcare

- Telecommunications

- Education and EdTech

- Construction

- Travel

- Security

Key Attributes of our CFOs delivering superior business services

1. Industry Knowledge: Our experienced CFOs with industry expertise provide invaluable insights for making informed financial decisions that contribute to the long-term success of any organization.

2. Qualified Professionals: Our team comprises certified Chartered Accountants, CPAs, and finance postgraduates from prestigious institutions.

3. Results- driven: Our CFOs are results-driven, with a focus on adding value to the organization by efficiently achieving goals.

4. Perceptive: The CFOs assess existing situations, anticipate financial adjustments, and provide strategic advice for better outcomes.

5. Adaptive: Our professionals are very adaptive, continually seeking novel and more effective strategies to fulfill goals and seize opportunities when they emerge.

Read Our Blogs

Why do you need virtual CFO services?

- Skilled in accounting and financial functions

- Proficient in meeting funding needs

- Expertise in implementing best financial practices for businesses

- Experienced across diverse industry verticals

- Proficient in business planning and execution

- Extensive team leadership experience

- Cost-effective due to working part-time.

Why choose Best CFO Solutions?

When you collaborate with Best CFO Solutions, you gain access to the invaluable financial and strategic insights typically provided by a CFO, without committing to a full-time hire.

Our team of highly qualified financial consultants possesses the essential skills and expertise to efficiently resolve even your company’s most complex financial challenges. With our virtual CFOs, your company can now leverage our expertise and experience to take your financial management to new heights, allowing you to meet your strategic goals and drive sustainable growth.

Contact Us Now!

Email Us

Call Us

→Data Security

→High-Quality Services

→Highly Experienced Team

→Customized Pricing Plans

→Dedicated Supervisor

→Improved Customer Service

→24*7 Support

Get A Free Consultation!

FAQs

1. What is an outsourced CFO?

An outsourced CFO is a financial professional hired by a firm to provide financial management and advisory services for a specific project or on an ongoing basis, rather than being a full-time employee.

2. Why outsource your CFO services?

Outsourcing CFO services offers expert assistance without incurring high costs. While it’s not mandatory to hire a virtual CFO to maximize business growth, they can play a vital role.

3. Can a start-up afford to outsource its CFO services?

A virtual CFO is a cost-effective alternative for startups that lack the resources or expertise to fully utilize a full-time CFO. It provides necessary financial advice at a fraction of the cost without the hassle of hiring an in-house CFO.